🏛️Midwest IPO – Everything You Should Know

1. Introduction to Midwest IPO

The Midwest IPO has become a hot topic in India’s primary markets in October 2025. Midwest Ltd, a Telangana-based natural stone and quartz processor, is planning to raise ₹451 crore through its public offering.

As an investor, understanding the structure, valuation, risks, and timing is critical before placing a bid.

2. Company Background: Midwest Ltd

Midwest Ltd is engaged in the mining, processing, and export of granite, natural stone, and quartz.

Key attributes:

- It is among India’s leading producers of Black Galaxy Granite—a premium variety.

- Operates multiple quarries and processing units, serving both domestic and global demand.

- Has scale advantages, control over raw material sources, and markets in engineered stone & export segments.

This business model is cyclical and capital intensive, but with the right growth trajectory, it can reward long-term investors.

3. Why Midwest is Going Public

Midwest is raising capital via IPO for multiple strategic reasons:

- Expansion & CapEx: A portion will go toward expanding its quartz processing facility (Phase II).

- Electric & Sustainable Assets: To acquire electric dump trucks and invest in solar energy systems at mining sites.

- Debt Reduction & Working Capital: To pare down existing debt and strengthen liquidity.

- Better Visibility & Credibility: A public listing helps in branding, credibility, and access to capital markets for future funding rounds.

4. Midwest IPO Structure & Size

The Midwest IPO is structured as a mixed issue:

- Total size: ₹451 crore

- Fresh issue (new shares): ₹250 crore

- Offer for Sale (OFS) by promoters: ₹201 crore

Thus, capital raised via fresh issue comes to the company, while OFS proceeds go to selling shareholders.

FOR MORE VISIT DEVBHOOMI

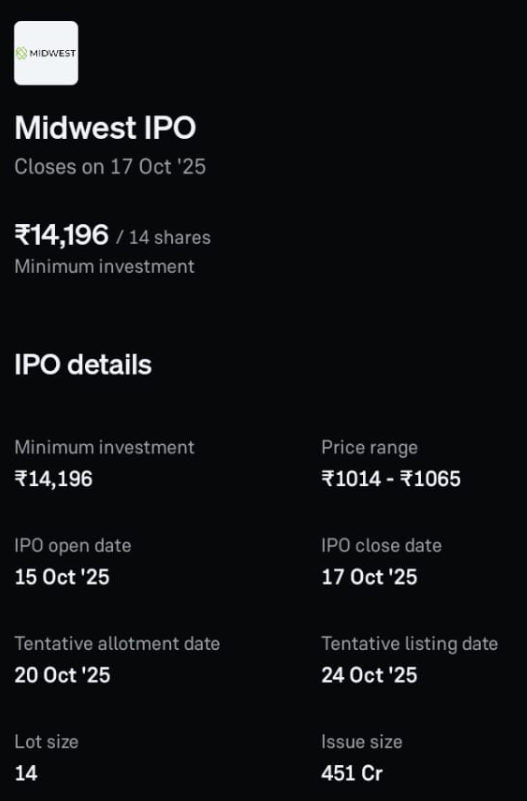

5. Midwest IPO Price Band, Lot Size & Minimum Investment

- Price band: ₹1,014 to ₹1,065 per share (face value ₹5)

- Lot size: 14 shares per lot

- Minimum investment:

- At the upper end, 14 × ₹1,065 = ₹14,910

- (Lower bound = 14 × ₹1,014 = ₹14,196)

Investors must bid in multiples of 14 shares.

6. Midwest IPO Key Dates & Timeline

Here’s the current schedule:

| Event | Date or Expected Date |

|---|---|

| IPO opens for subscription | 15 October 2025 |

| IPO closes | 17 October 2025 |

| Allotment finalization | 20 October 2025 |

| Refunds & share credit | 23 October 2025 |

| Listing date | 24 October 2025 |

Note: Anchor investor allocation happens on 14 October (day before public subscription).

Also, lock-in for anchor investors will apply post listing.

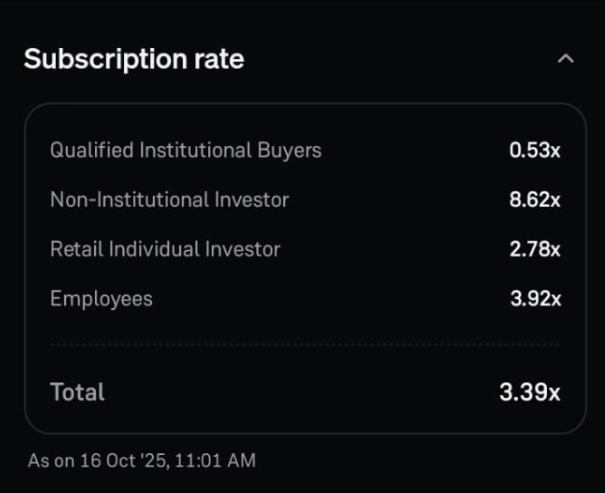

7. Midwest IPO Allocation & Reservation

The allotment and reservation norms are as follows:

- Qualified Institutional Buyers (QIBs): Up to 50% of net offer

- Retail Investors: At least 35% of net offer

- Non-Institutional Investors (NII / HNI): Minimum 15%

- Employee Reservation: A portion (face value up to ₹1 crore) is reserved for eligible employees.

- Anchor Investors: They are allocated shares before the IPO opens to public, often at upper price band.

This mix ensures participation from institutions, retail, and employees.

8. Financials & Valuation Metrics

From its regulatory filings (RHP) & public disclosures:

- Midwest’s revenue and profit metrics show moderate growth, with decent margins.

- In FY 2024, the company had a revenue of ~₹603.33 million and PAT (Profit after Tax) of ~₹96.53 million (per some sources)

- Promoters’ holding before issue is ~95.83%, which will reduce post-IPO.

- Post-IPO, the public holding will increase to ~15.61%.

Implied valuation depends heavily on the allotment price and market sentiment. Multiples like P/E, EV/EBITDA will be key to assess whether Midwest is richly priced or undervalued relative to peers.

9. Midwest IPO Strengths & Growth Drivers

Some of the upside factors include:

- Niche & premium stone segment: Black Galaxy and Absolute Black have limited sources, giving Midwest pricing power.

- Export orientation: Access to global markets can hedge domestic cyclicality.

- Backward integration & control over raw materials: Having its own quarries ensures supply stability.

- Sustainability push: Investment in electric trucks and solar may improve cost structure long term.

- Scalability: Expansion of processing capacity can fuel growth if demand holds.

These strengths make the IPO attractive but must be weighed against macro challenges.

10. Midwest IPO Risks & Challenges

No IPO is without risks. Some possible pitfalls for Midwest

- Commodity risk & price volatility: Stone & quartz prices can fluctuate with demand cycles.

- Operational risks & cost overruns: CapEx expansions may overshoot budget or face delays.

- Regulatory / environmental constraints: Mining and forestry rules may change.

- Currency and export risks: Global demand or foreign exchange headwinds may hit margins.

- Valuation risk: If pricing is too steep, listing gains may be limited or negative.

Investors should carefully read risk factors in the RHP.

11. Peer Comparison & Industry Benchmarking

Comparing Midwest with other listed or recent IPO players in the stone / engineered stone / mineral sector can help gauge valuation multiples. Some comparisons emphasize:

- How Midwest’s margins compare to peers

- Growth rates vs competitors

- Debt levels and capital structure

- Geographic & product diversification

One IPO analysis piece suggests that Midwest is “winning the valuation game vs Pokarna” (a peer in stone / quartz), hinting favorable multiples.

12. Midwest IPO Grey Market Premium (GMP) & Market Sentiment

GMP is an unofficial indicator reflecting investor appetite in the grey market:

- For Midwest IPO, the GMP is quoted around ₹125 (~11.7% premium above upper band) in some commentary.

- Unofficial trading shows shares being quoted ~₹1,210 (i.e. ~13-14% premium) in grey market reports.

- While helpful as a gauge, GMP is not guaranteed — the actual listing may deviate.

Positive GMP suggests strong demand, but it should not be the only basis for investing.

13. Midwest IPO Listing Gain Simulation (Using GMP)

Grey Market Premium (GMP) gives a hint of listing demand. Let’s simulate listing gains:

Assume issue at upper band ₹1,065. With GMP ~ ₹145:

- Implied listing price = 1,065 + 145 = ₹1,210 → that is ~ 13.6% gain

- Some market commentary suggests GMP rising to ₹175 → listing ~1,240 → ~ 16.4% gain

We can simulate:

| GMP Scenario | GMP (₹) | Listing Price (₹) | % Gain over ₹1,065 |

|---|---|---|---|

| Conservative | ₹100 | ₹1,165 | 9.4% |

| Base / Current | ₹145 | ₹1,210 | 13.6% |

| Optimistic | ₹175 | ₹1,240 | 16.4% |

| Ultra Bullish | ₹200 | ₹1,265 | 18.8% |

Also, note that GMP is volatile and can change until listing. Sometimes listing ends lower than GMP-implied.

We can also compare with derived “fair value” from model (₹1,059). The GMP suggests market expects better premium multiple / sentiment.

So, possible listing scenarios:

- Scenario A (Modest Listing Pop): ₹1,165 (9–10% gain)

- Scenario B (Likely / Market Sentiment Case): ₹1,210 (~13–14%)

- Scenario C (Strong Market & Hype): ₹1,240 (16–17%)

- Scenario D (Overheated / Speculative): ₹1,265 (19%)

If shares list above ₹1,200, that suggests market pricing in growth, momentum and optimism beyond base fundamentals.

14. Midwest IPO Risks, Sensitivities & Caveats

- The entire model is very sensitive to multiple assumptions (EV/EBITDA, margins)

- The debt number, cash, working capital assumptions may differ in actual RHP

- GMP is an unofficial indicator — listing could deviate materially

- Market sentiment, macro conditions, listing day demand/supply will heavily influence actual outcome

- The fresh issue proceeds deployment (execution risk) matters post-listing

- Dilution effect, promoter locking, lock-in periods can influence pricing

15. How to Apply for Midwest IPO

Steps to participate:

- Open a demat + trading account, if not already held.

- Use your broker / IPO platform and go to the “IPO / New Issues” section.

- Select Midwest IPO, enter the number of lots (in multiples of 14 shares).

- Choose bidding price / “cut-off” (if offered) within ₹1,014 to ₹1,065.

- Block funds via ASBA (bank account) or UPI mechanism, as per your broker.

- Monitor allotment status after the IPO closes (on 20 Oct expected).

- If allotted, shares will be credited and listed on exchanges (tentatively 24 Oct).

Many brokers and platforms provide autopay or UPI payment integration.

16. Post-Listing Outlook & Scenarios

Based on performance and sentiment, here are possible scenarios:

- Listing Pop / Gains: If market conditions are strong, listing price may exceed upper band + GMP.

- Modest Listing: Market may price it close to IPO band without high premium.

- Flat / Negative Listing: If demand weakens, listing might be lower, and initial investors could face losses.

Longer term, performance will depend on execution — meeting expansion targets, controlling costs, and maintaining demand traction.

17. Key Takeaways & Investor Checklist

Pros

- Solid business in niche premium stone segment

- Mixed funding for growth + debt reduction

- Strong GMP signals demand

Cons / Red flags

- High capital intensiveness & execution risk

- Cyclical commodity & export exposure

- High IPO pricing may limit margin of safety

Checklist before you bid

- Is the valuation reasonable relative to peers?

- Do you understand the risk disclosures in RHP?

- Are you comfortable with the lock-in and listing uncertainties?

- Can you hold long term if listing gains don’t materialize?

18. Frequently Asked Questions (FAQs)

Q1. When does the Midwest IPO open and close?

A1. It opens on 15 October 2025 and closes on 17 October 2025.

Q2. What is the price band and lot size?

A2. The band is ₹1,014 to ₹1,065 per share, and the lot size is 14 shares.

Q3. How much minimum money is needed to apply?

A3. At the upper price, a single lot costs ₹14,910.

Q4. What is the allocation among QIB, Retail, NII?

A4. QIB up to 50%, Retail at least 35%, NII at least 15%.

Q5. When is the expected listing date?

A5. Tentatively 24 October 2025 on BSE & NSE.

Q6. Is GMP a reliable indicator?

A6. No, GMP is an unofficial sentiment indicator and does not always translate into actual listing performance.

19. Conclusion

The Midwest IPO offers a compelling case for investors seeking exposure in the natural stone and quartz sector. With its established business, growth ambitions, and favorable initial demand indicators (i.e. strong GMP), it garners interest.

However, the IPO is not without risks. Pricing, execution, and external market conditions will play a crucial role. For investors, the decision should balance optimism with caution — bidding only what you can afford to hold and closely monitoring post-listing dynamics.