💼 LG Electronics IPO : GMP, Price Band, Fundamentals, and Key Details You Need to Know

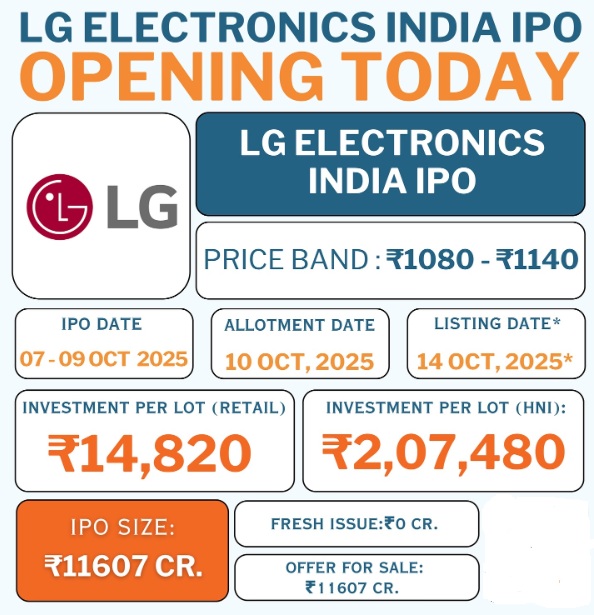

The much-awaited LG Electronics IPO has finally opened for subscription from October 7 to October 9, 2025, marking one of the biggest public issues of the year.

Investors are keenly watching this mega issue worth ₹11,607 crore, as it represents the first-ever IPO from a major global consumer electronics giant’s India arm.

From its strong brand presence to its profitable growth, the LG Electronics IPO has generated buzz across retail, HNI, and institutional investors. Let’s decode every crucial detail — including price band, GMP, fundamentals, and listing expectations.

🔍 IPO Highlights — Key Details at a Glance

| Parameter | Details |

|---|---|

| IPO Name | LG Electronics India Ltd |

| IPO Opening Date | October 7, 2025 |

| IPO Closing Date | October 9, 2025 |

| Allotment Date | October 10, 2025 |

| Listing Date | October 14, 2025 |

| Price Band | ₹1,080 – ₹1,140 per share |

| Lot Size | 13 shares per lot |

| Issue Type | 100% Offer For Sale (OFS) |

| Total Issue Size | ₹11,607 crore |

| Investment (Retail) | ₹14,820 minimum |

| Investment (HNI) | ₹2,07,480 minimum |

| Anchor Investors | ADIA, Goldman Sachs, Temasek, Norway Fund |

| Listing Exchanges | BSE, NSE |

(Source: ET Markets, Moneycontrol, Reuters, IPOWatch)

💰 Current GMP (Grey Market Premium)

The GMP (Grey Market Premium) is often considered a reliable sentiment indicator before the IPO listing.

As of October 8, 2025:

- Current GMP: ₹175 per share

- Estimated Listing Price: ₹1,300+ (around 15–20% premium)

- Market Sentiment: Strongly positive; expected to deliver double-digit listing gains if market conditions remain stable.

💬 According to IPOWatch and ETMarkets, the LG Electronics IPO has received robust demand in the grey market, reflecting strong investor confidence and brand trust.

🧾 About LG Electronics India Ltd

LG Electronics India Ltd is a wholly owned subsidiary of South Korea–based LG Electronics, one of the world’s leading consumer electronics and home appliance brands.

🌍 Business Overview

The company operates across multiple product categories:

- Consumer Electronics (TVs, Refrigerators, Washing Machines, ACs)

- Home Appliances and Smart Devices

- Kitchen Appliances and Monitors

- Commercial Displays and IoT-enabled solutions

It enjoys a dominant market share in India’s home electronics sector, competing with brands like Samsung, Whirlpool, and Sony.

⚙️ Expansion and Manufacturing Footprint

LG Electronics India has expanded significantly under the “Make in India” initiative:

- Established a new $600 million manufacturing unit in Andhra Pradesh in 2025.

- Plans to make India a global export hub for electronics components.

- Employs over 6,000 direct workers and supports over 50,000 indirect jobs through vendors and suppliers.

(Source: Reuters India Business Report, May 2025)

Keir Starmer’s recent India visit also included discussions on UK-India technology collaboration, indirectly benefiting companies like LG that rely on international innovation and supply chains.

📊 Financial Performance & Fundamentals

| Financial Metric (FY24–25) | Value |

|---|---|

| Revenue | ₹32,000+ crore |

| Net Profit | ₹2,650 crore |

| EBITDA Margin | 13.2% |

| ROE (Return on Equity) | 18% |

| Debt-to-Equity Ratio | 0.25 (very healthy) |

| EPS (Earnings per Share) | ₹45.8 |

| P/E Ratio (at upper band) | 24.8x |

💹 Interpretation

- Strong profitability and consistent growth reflect LG’s leadership in the Indian market.

- Debt-light balance sheet gives it room for future expansion.

- Valuation remains reasonable compared to peers like Voltas, Blue Star, and Whirlpool India.

(Source: Moneycontrol Analysis, October 2025)

🧭 Strengths of LG Electronics IPO

- Strong Brand Trust: Decades of leadership in India’s consumer electronics segment.

- Wide Distribution Network: Presence in 500+ cities and 2,000+ service centers.

- Solid Financials: Profitable and debt-light structure.

- Technological Edge: Consistent innovation in smart and connected devices.

- Export Growth: Strategic push toward international markets from Indian plants.

⚠️ Key Risks to Consider

- Pure OFS Issue: Company won’t receive fresh funds — existing shareholders are offloading stakes.

- Competitive Market: Aggressive pricing from local and Chinese players could pressure margins.

- Currency and Import Risks: Dependence on imported components may impact costs if currency fluctuates.

- Economic Slowdowns: Consumer durable demand is cyclical; may dip during slow growth phases.

💬 Expert Views — Should You Subscribe?

| Brokerage / Analyst | Recommendation | Remarks |

|---|---|---|

| Motilal Oswal | ✅ Subscribe | Strong brand, attractive valuation |

| Angel One | ✅ Subscribe | Robust balance sheet and FTA with Korea |

| SMC Global | ⚖️ Neutral | OFS issue, limited direct fund inflow |

| HDFC Securities | ✅ Long-Term Buy | Growth in smart home segment |

Most brokerages recommend a “Subscribe” or “Long-Term Buy” rating, citing LG’s strong fundamentals, brand loyalty, and consistent profits.

📈 Expected Listing Performance

If the current GMP trend sustains and market sentiment remains bullish:

- Expected Listing Price: ₹1,300 – ₹1,350

- Potential Listing Gain: 15% to 20%

- Long-Term Target (12 Months): ₹1,550+ (based on FY26 earnings estimates)

🧠 Investor Takeaway

The LG Electronics IPO stands out for its scale, credibility, and strong fundamentals. Although it’s a 100% Offer For Sale, meaning no fresh capital is raised, the brand’s robust performance and profitability make it a promising long-term pick.

Investors with a medium to long-term horizon can consider applying, especially given LG’s strategic role in India’s consumer electronics ecosystem and manufacturing expansion.

🧾 Quick Recap

| Key Factor | Verdict |

|---|---|

| Brand Strength | ★★★★★ |

| Financial Health | ★★★★☆ |

| Valuation | ★★★★☆ |

| Listing Gains Potential | ★★★★☆ |

| Long-Term Growth Outlook | ★★★★★ |

❓FAQs

Q1. What is the LG Electronics IPO GMP today?

➡ The current GMP is around ₹175, suggesting a potential 15–20% listing gain.

Q2. What is the price band of the LG Electronics IPO?

➡ The price band is ₹1,080 to ₹1,140 per share.

Q3. Is LG Electronics IPO a good investment?

➡ Yes, experts recommend subscribing due to LG’s strong brand, profitability, and steady growth in India.

Q4. When will LG Electronics IPO list?

➡ The listing is scheduled for October 14, 2025, on NSE and BSE.